Miami’s real estate landscape is entering a fascinating inflection point. Following years of meteoric growth, property sales have softened, yet Miami real estate for foreign investors continues to attract steady interest and capital.

📉 Slump in Sales, But Prices Still Climb

- Total residential sales across Miami‑Dade, Broward, and Palm Beach counties dropped to US $5.6 billion in May 2025, down from $6.1 billion in May 2024—a ~8% annual decline—according to the Miami Association of Realtors.

- Specifically, Miami‑Dade County experienced a 20% drop in sales, with condo transactions down roughly 25%, though the median home price rose to $675,000, marking 162 consecutive months of price growth.

🌍 A Global Magnet for International Buyers

- As of Q1 2025, Miami captured 8.7% of all international home-buying interest in the U.S., making it the top market for foreign buyers.

- Latin American investors—notably from Brazil, Colombia, Argentina, Mexico, and Peru—accounted for more than 45% of international transactions in early 2025. Peruvians alone invested over US $213 million in 2024, targeting hotspots like Brickell, Edgewater, and Doral.

💼 Foreign Buyers: Why They’re Choosing Miami

- Dollar stability and legal transparency in the U.S. remain powerful draws amid economic volatility in Latin America.

- Financing options supporters: foreign nationals can finance up to 60–70% of property value at rates between 6–8%, leading to projected rental returns of 5–7% annually.

Strategic structuring via LLCs offers legal protections, tax optimization, and anonymity—especially vital for non-residents.

🏨 Income-Generating Use Cases

- Condo-hotels & short-term rentals

- Backed by hotel operators, they offer hands-off management and occupancy rates buoyed by Miami’s tourism boom (~26 million visitors in 2024).

- Prime locations like South Beach, Brickell, Wynwood, and Little Havana command robust nightly rates and yield potential.

- Backed by hotel operators, they offer hands-off management and occupancy rates buoyed by Miami’s tourism boom (~26 million visitors in 2024).

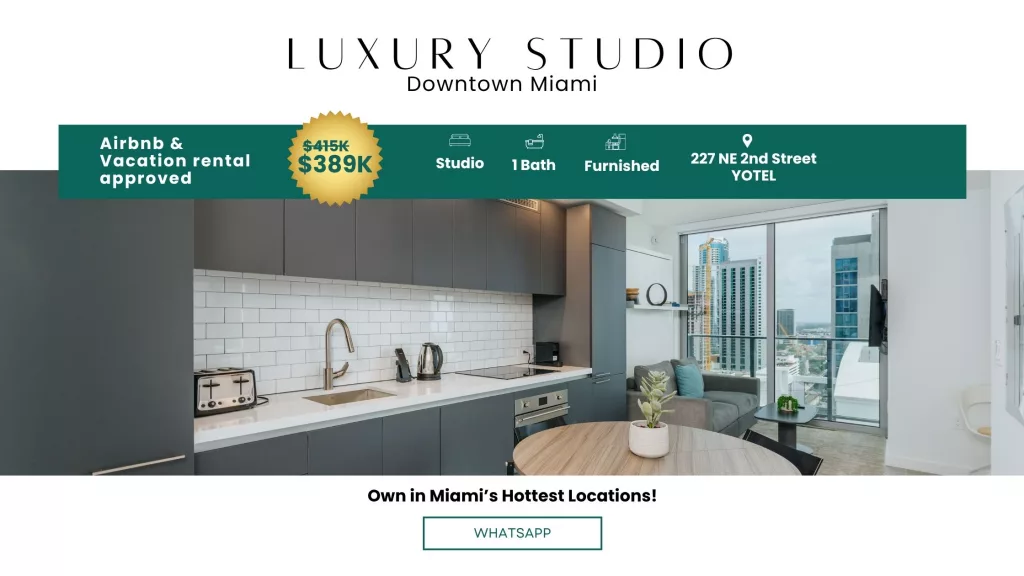

- Luxury Airbnb-designated high-rises

- Developments are emerging specifically for short-term rentals, with resort-style amenities targeting Airbnb investors across downtown Miami.

- Developments are emerging specifically for short-term rentals, with resort-style amenities targeting Airbnb investors across downtown Miami.

- Multifamily assets

- Nearly 221 multifamily transactions in the past year, with average prices around $302,075 per unit and ~6% average vacancy rates.

- However, new deliveries (16,860 units in 2025) are lagging demand (expected absorption: 20,790 units), signaling a tightening rental market.

- Nearly 221 multifamily transactions in the past year, with average prices around $302,075 per unit and ~6% average vacancy rates.

- Mixed-use towers (e.g. The Standard Residences)

One of Miami’s latest mixed-use marvels is The Standard Residences, a sleek, 45‑story branded condo tower rising at 690 SW 1st Avenue within the One Brickell Riverfront development. Designed by Arquitectonica with interiors by GOOD.RICH and The Standard’s in-house team, the building offers 422 residences—from 500 sq ft studios to 1,100 sq ft two-bedroom units—starting around US $600,000.

Amenities are curated for seamless live‑work‑play lifestyles:

- A 45th‑floor rooftop pool, club lounge, private dining kitchens, and co‑working spaces

- 10th‑floor wellness spa featuring infinity plunge pools, steam rooms, sauna, fitness center, bowling alley, pet spa, and screening room

- Ground‑floor riverfront restaurant and signature ninth‑floor eatery, plus concierge services

- Exclusive “Friends With Benefits” discounts at Standard Hotels worldwide

Strategically located in Brickell—Miami’s financial hub and growing “Silicon Beach”—The Standard sits nearby of Brickell City Centre, Metromover/Metrorail stations, waterfront parks, and a vibrant dining/shopping scene. This positions it as a compelling option for foreign investors seeking a branded residence that can double as a high‑end short‑term rental, offering both strong rental income and capital appreciation potential.

💵 Returns & Risks

| Strategy | Estimated Yield | Upside | Risks |

| Short‑term rentals | 5‑7% | High occupancy in tourist zones | Regulatory shifts, seasonality |

| Multifamily holdings | 4‑6% net | Stable monthly rental demand | Market downturn, vacancy spikes |

| Condo‑hotels | 6‑8% nightly | Operated by hotel teams | Tax/FIRPTA surprises, fees, taxes |

Note: The FHFA reports average annual appreciation in Miami since 1992 at 7.2%, with slight recent slowdown into early 2025

📑 Tax & Regulatory Landscape

- IRS filing: Foreign owners must get a U.S. Individual Taxpayer Identification Number and file returns on rental income en.wikipedia.org+1hco.com+1.

- Key considerations: FIRPTA withholding (30% on sale), entity vs. passive investment classification, and available deductions via operating as a U.S. trade/business

State advantage: No Florida state income tax enhances net return potential

📌 What This Means for Foreign Investors

- The market is cooling from its pandemic height, with softer volumes but steady price gains—expected to grow at 3–5% annually through 2026

- Tourism-led rental models remain highly appealing given Miami’s visitor base and lifestyle perks.

- Foreign capital continues to pour in, with 44% of international investors planning to increase U.S. holdings in 2025, despite some global trade uncertainty

- Strategic investors stand to benefit from stabilized prices, robust rental yields, and a friendly tax/legal environment—but must manage financing, compliance, and climate risk factors.

🔍 In Summary

While Miami’s real estate market faces a momentary stabilization, it remains a compelling hub for foreign investment. Dollar resilience, legal clarity, and strong rental fundamentals—especially in multifamily and short-term structures—ensure continued appeal. With thoughtful structuring and professional guidance (e.g., via LLCs, tax advisors, and management firms), international buyers can generate steady income and long-term wealth in a premier global city.